Liam Payne passes away at 31, Former One Direction Singer

October 17, 2024

“Israeli forces report the killing of a senior Hamas leader Yahya Sinwar, in the ongoing conflict in Gaza.”

October 18, 2024Over 1 Million Public Service Workers have benefited from This Administration

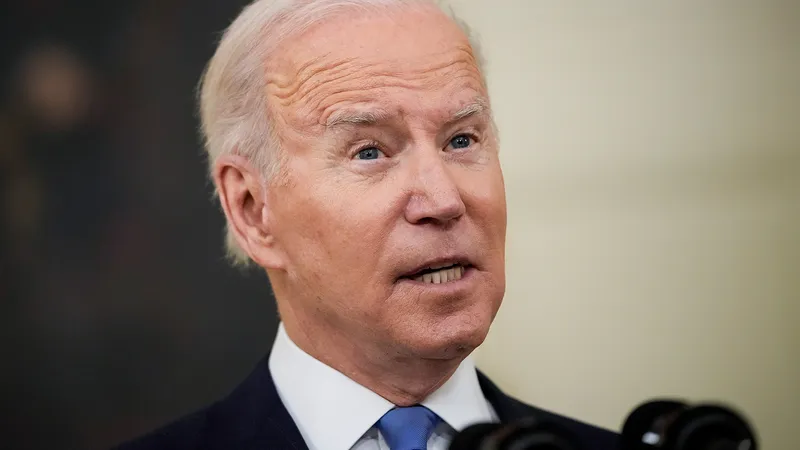

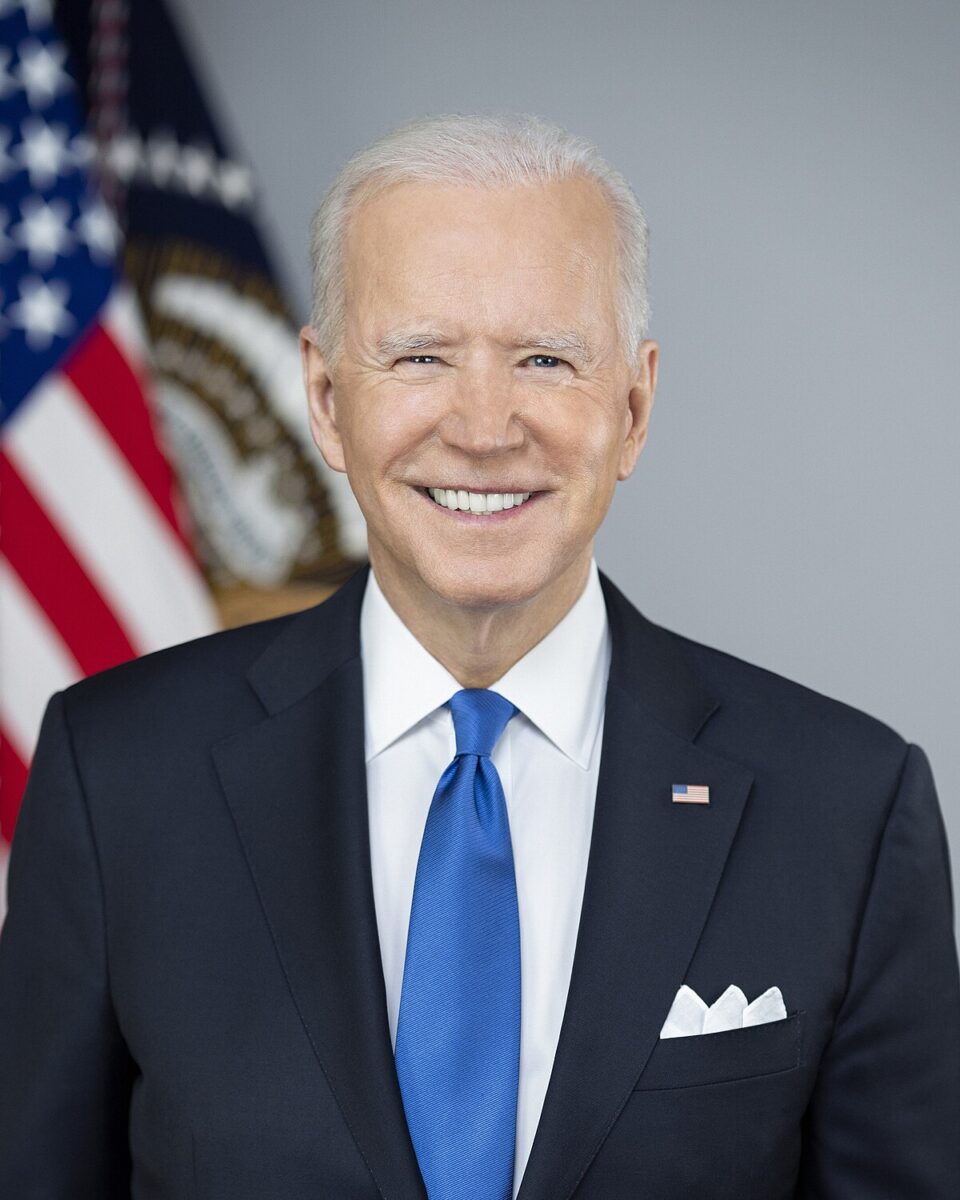

On Thursday, U.S. President Joe Biden announced the cancellation of $4.5 billion in student debt for over 60,000 borrowers, marking a significant milestone in his administration’s efforts to alleviate student loan burdens. This latest move brings the total number of public service workers who have had their loans forgiven under Biden’s administration to over 1 million. The administration’s broader efforts to address student loan debt have provided $175 billion in relief to nearly 5 million borrowers, according to a statement from the White House.

Biden’s student debt relief actions are part of a larger agenda to ease the financial pressures on millions of Americans, especially those working in public service sectors, such as teachers, nurses, and government employees. Through targeted forgiveness programs, including the Public Service Loan Forgiveness (PSLF) program, the administration has focused on assisting borrowers who have dedicated their careers to public service. By ensuring that more people qualify for debt cancellation, the administration has worked to rectify long-standing issues with the PSLF program, which previously denied relief to many eligible borrowers due to bureaucratic and technical errors.

However, Biden’s approach to student loan forgiveness has not been without controversy. Republicans have consistently criticized his actions, arguing that such widespread debt cancellation is an overreach of executive authority. They contend that providing relief to college-educated borrowers is unfair to those who did not attend college or have already paid off their loans. Some also argue that it places a disproportionate financial burden on taxpayers who do not benefit directly from the relief measures.

Earlier this month, a legal challenge to Biden’s debt relief plan emerged when U.S. District Judge Matthew Schelp, based in St. Louis and appointed by former President Donald Trump, issued a preliminary injunction. This injunction temporarily blocked the Biden administration from proceeding with what critics call “mass cancelling” of student loans. The ruling effectively halted the administration’s plan to forgive principal or interest on loans for a broad swath of borrowers, pending the outcome of a lawsuit filed by multiple states challenging the legality of Biden’s initiative.

The legal battle centers on whether the executive branch has the authority to unilaterally forgive student debt on a large scale. Republicans argue that such authority rests with Congress, not the president. The Biden administration, on the other hand, maintains that it has the legal grounds to act, particularly in light of the ongoing economic challenges many Americans face due to the COVID-19 pandemic. Biden has emphasized the importance of reducing financial stress for borrowers, noting that student debt relief can play a crucial role in promoting economic stability and allowing individuals to invest in their futures.

The preliminary injunction issued by Judge Schelp is part of a broader legal and political struggle over the Biden administration’s efforts to address the student loan crisis. The lawsuit, filed by several Republican-led states, challenges the legality of Biden’s plan to forgive up to $20,000 in federal student loans for borrowers earning less than $125,000 annually. The states argue that such relief would hurt their economies, particularly those that benefit from interest payments on student loans.

Despite the legal challenges, the Biden administration remains committed to pursuing student debt relief. In response to the injunction, the White House expressed disappointment, stating that the plan is crucial for millions of Americans burdened by student debt. The administration has vowed to continue fighting in court to ensure that borrowers receive the relief they were promised.

The Biden administration’s debt relief efforts have been particularly focused on individuals who work in public service, a group that has long been targeted for loan forgiveness under the PSLF program. In recent years, the program faced significant criticism due to its complexity and high denial rates. Many borrowers who believed they qualified for loan forgiveness were denied due to administrative errors or miscommunications. In response, the Biden administration has implemented reforms aimed at simplifying the process and expanding eligibility, making it easier for public service workers to access the forgiveness they were promised.

The $175 billion in relief approved under Biden’s administration includes not only PSLF forgiveness but also debt cancellation for borrowers defrauded by for-profit colleges and relief for individuals with permanent disabilities. These actions reflect Biden’s broader goal of creating a more equitable higher education system, one that does not saddle Americans with lifelong debt for pursuing their educational goals.

Biden’s latest move to cancel $4.5 billion in student debt for over 60,000 borrowers highlights his administration’s ongoing efforts to address what many see as a growing student loan crisis in the U.S. While legal challenges continue to complicate the path forward, the president has made it clear that student debt relief will remain a priority for his administration. The outcome of the legal battles surrounding Biden’s debt cancellation efforts will have far-reaching implications, not only for the borrowers directly affected but also for the future of student loan policy in the United States.

As the political and legal debates unfold, the administration’s focus on easing the financial burden for millions of Americans underscores a key aspect of Biden’s domestic agenda: providing economic relief to those who need it most. Whether or not Biden’s broader student loan forgiveness plans survive the legal challenges, his actions so far have provided meaningful relief to millions and set the stage for ongoing discussions about the future of student debt in America.